Active Risk Management: The yellow of the egg

Since the financial crisis, investment management has become a major challenge: Interest rates have fallen to record lows, while stocks and commodities are exposed to large price swings. Only active risk management helps genuinely in this environment according to Silvano Grimaldi of Grimaldi & Partners Ltd.

During the last four years the priority was not profit maximization, but risk management. Silvano Grimaldi of the Zurich based Asset Management Company Grimaldi & Partners Ltd. understands under risk management preserving capital while retaining the opportunity to generate capital gains. This requires great discipline, "profits are to be taken consequently, and losses should be reduced before they become too big," says Grimaldi. This may limit the potential for higher profits, but losses will be reduced in a systematic way.

Fewer losses during negative phases, moderate gains in a positive environment

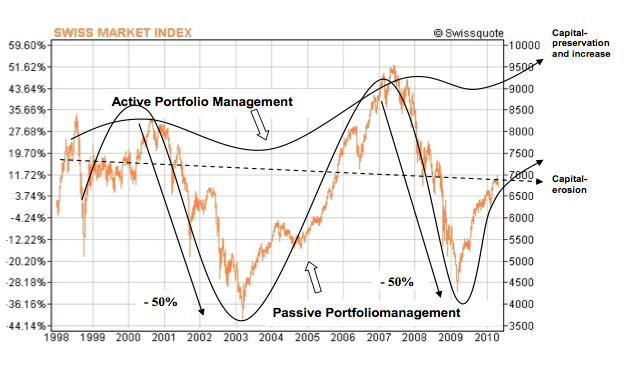

The performance figures demonstrate the efficiency of this strategy: In years with losses like 2008 or 2011, active risk management curtailed losses. When equity markets recovered, clients assets grew from a level higher than passively managed portfolios. The conclusion is: fewer losses during a market downturn and moderate gains in a positive environment. During the crash of Summer 2011, corporate bonds issued by financial companies dropped in value, which shows that each asset class is associated with specific risks. Therefore, active risk management should cover all asset classes. In periods of market turbulences, loss minimization should stand in the foreground. When market conditions improve, the generation of profits should have priority. Only then, according to Grimaldi, can client assets be protected and continuously increased. "Many banks did not achieve this in past years."

The markets remain flat with increasing volatility

It is also helpful to look at the active risk management strategy in a broader context: The long upward movement of the stock markets from 1980 to 1999 is long gone. Since then markets have been trending sideways with high volatility. A passive investment strategy in such an environment is highly nerve-wrecking and costs a lot of money in term of incurred losses. That’s means capital gains can suddenly melt and can recover again only after several months, if ever. And a loss of 50 percent need a price doubling to regain the starting level. But often after such a loss, fear dominates and the position is sold.

With different protection levels (stopp loss) according to asset manager Grimaldi such a development can be prevented: when book profits begin to shrink, they are realized at a defined level. Meanwhile, when losses exceed a predetermined level, they are realised. "As a result, a loss of substance can be largely prevented and that is the most important thing in asset management."

Moneycab - 3 September 2012