Certainty amid uncertain markets thanks to independent asset management

Grimaldi & Partners Ltd. is an independent asset manager under Swiss law, based in Zurich. The bank-independent status of Grimaldi & Partners Ltd will ensure the implementation of an individual investment strategy that in every market phase seeks to achieve good investment results. We assist successfully individuals and institutional clients from Switzerland and abroad.

Our proven investment concept - The cornerstone is th independent and neutral asset management

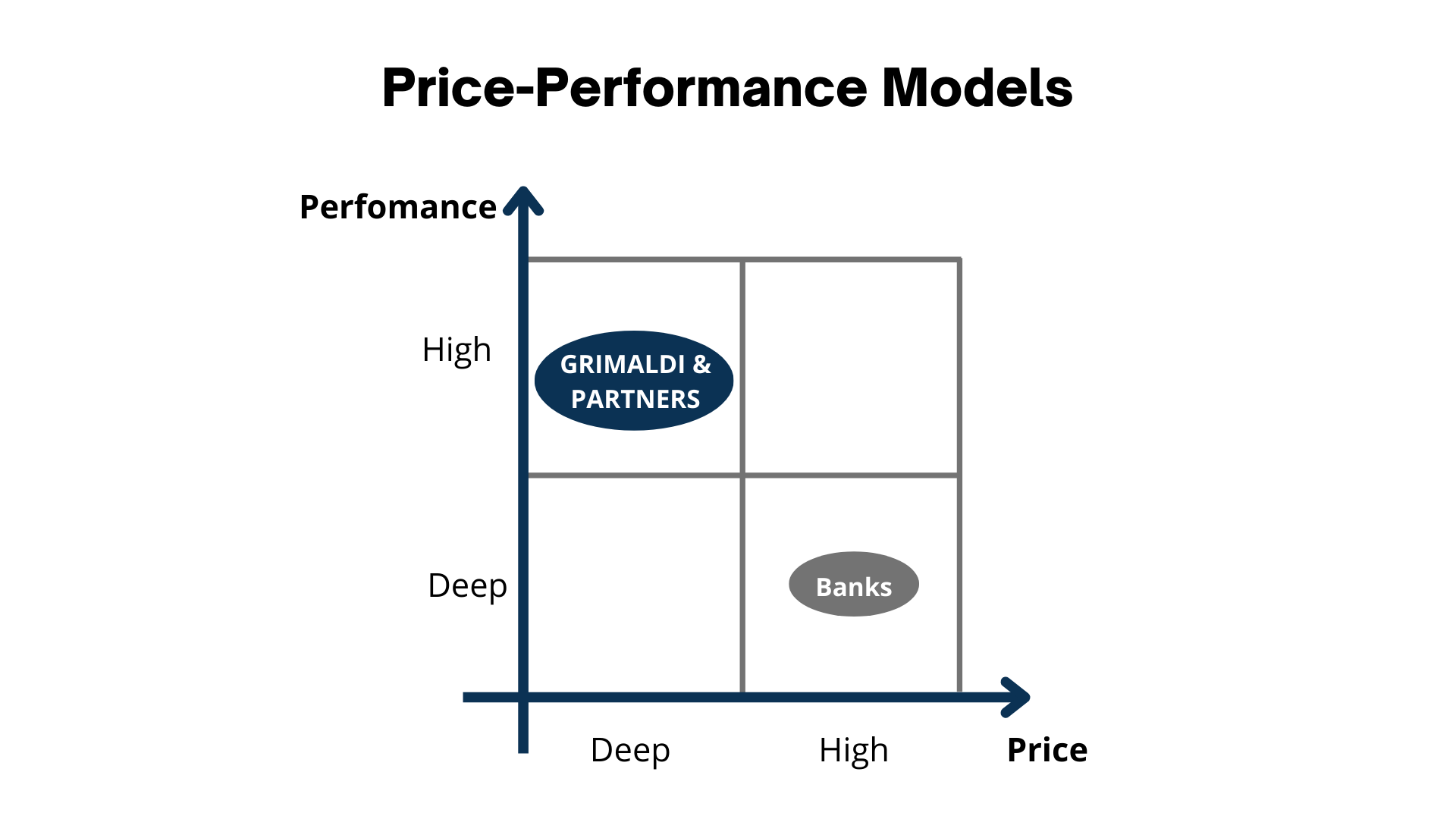

Our successfull formula: less costs - more return - better asset protection. The prerequisite is our bank-independent market position, because we only work according to strict company-internal guidelines without the influence of bank interests. Asset protection is our most important goal. We achieve this, among other things, by investing only in solidly managed and financially healthy companies and debtors. The result for our customers is a professionally and better invested portfolio: a better return without more risk at lower costs.

The implementation - efficiency and transparency create added value

Our efficient and independent investment process is characterized by a successful analysis and investment approach. Our assessments of the markets are independent of banks and are neutral. The investment strategy we created has developed better and more sustainably than the market in the past. In order to achieve this convincing performance, we use a scientifically recognized investment approach that has proven itself in practice. The success is proven in numerous studies.

The way to success - our successful and proven investment approach

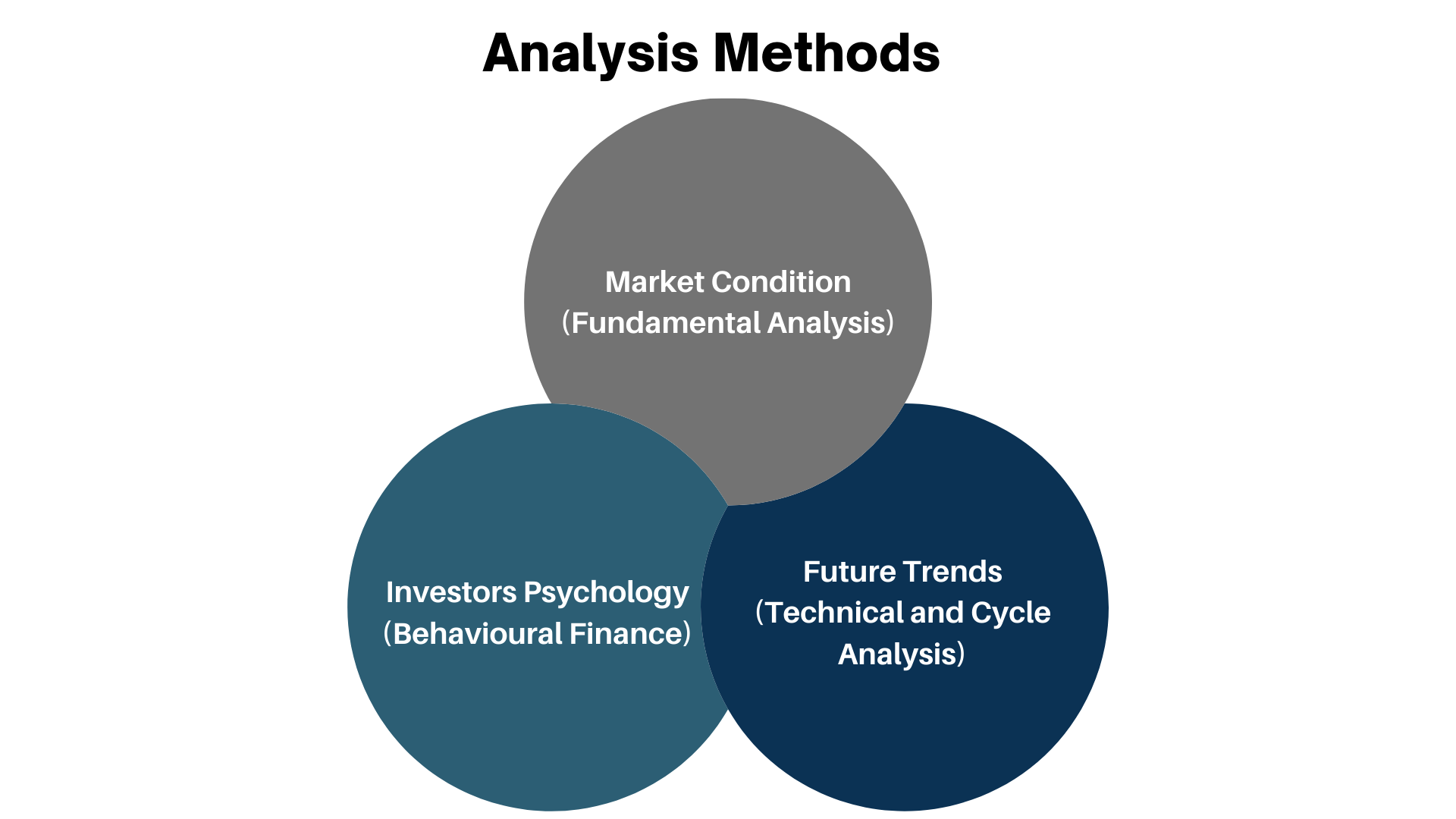

TOP-DOWN APPROACH: Where does the REAL ECONOMY stand?

We continuously evaluate the current economic data on the economy. We use them to gain a clear picture of the real economic environment and to find the most attractive countries and industries with the best earnings potential.

BOTTOM-UP-APPROACH: Where are the opportunities at the SINGLE TITLE level?

We put companies through their paces in order to identify high-quality companies whose stocks and bonds produce an attractive return (capital gains, dividends and interest) year after year. These securities stand for sustainability and security - even in the event of market turbulences.

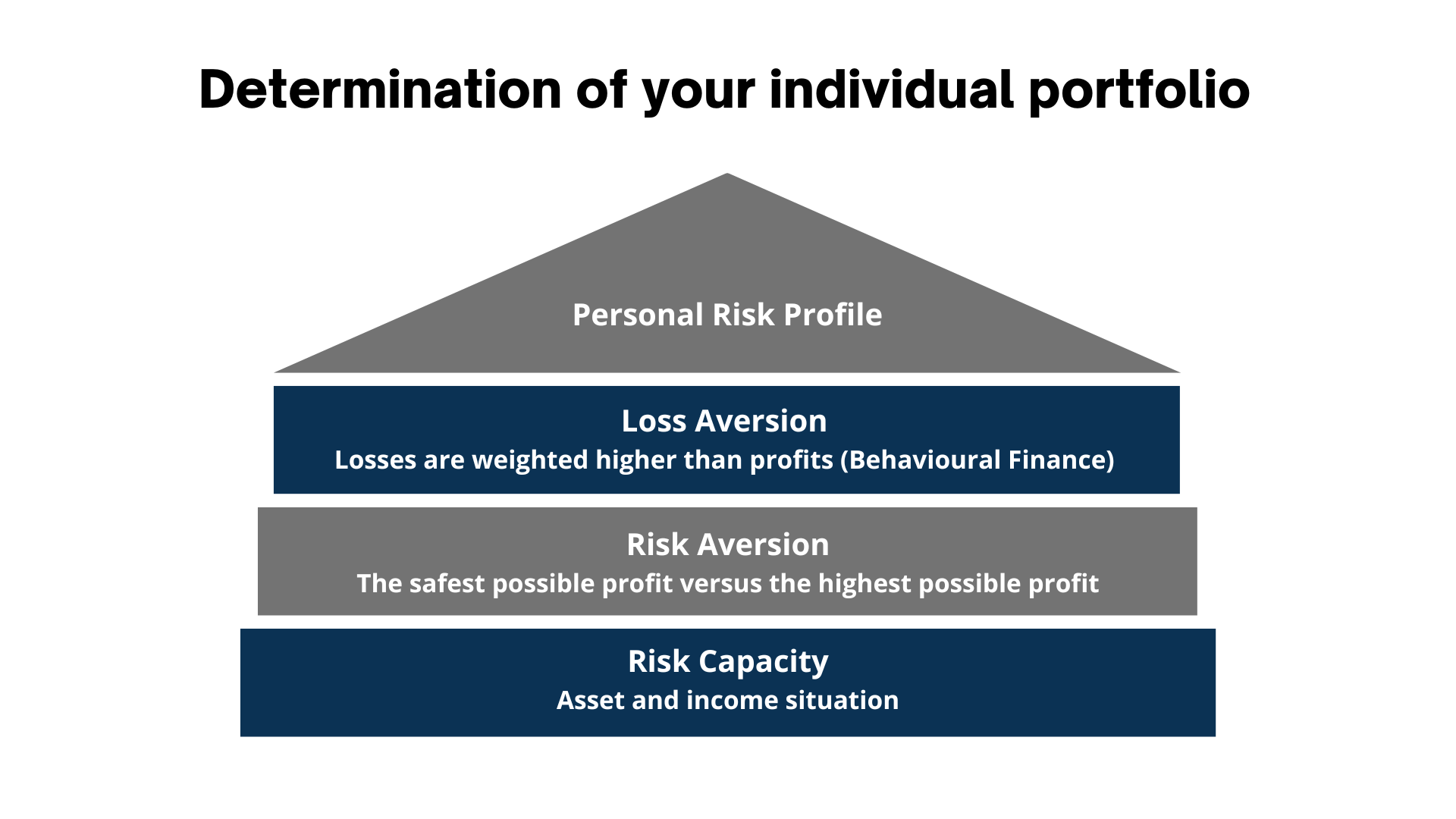

BEHAVIORAL FINANCE: Where is the INVESTOR PSYCHOLOGY?

We identify irrational investor behavior that leads to investment errors and use the resulting investment opportunities for the benefit of the client.

CYCLES AND TECHICAL CHARTS: Where is the JOURNEY going?

We get a flair for the future development of the stock markets or of individual stocks in order to anticipate them and act proactively.

The results and the performance - constantly better than the market

With our cost-conscious asset management that emphasizes performance and this with better asset protection, our clients can look forward to better results in the long term. Our investment results for the defensive, balanced and dynamic investment strategy in the main currencies CHF, EUR and USD constantly beat the market. Year after year we have been able to achieve an important overperformance compared to the market return.

Market reports

We regularly write about topics from the financial industry. Read our market assessments.

«Over the years, my conservatively invested portfolio at my bank has fallen continuously, even though the stock markets have risen. When I turned to the investment experts at Grimaldi & Partners Independent Assset Management, they explained to me why my assets were being eroded at my bank: The portfolio was not invested sustainably - too high costs and inadequate performance. I've been with Grimaldi & Partners for years: my portfolio is growing year after year, simply because the income from the distribution of interest and dividends already accounts for around 4% of the portfolio per year! »